We have found that many of our clients have the same kinds of questions on their minds. We hope this FAQ section will answer some of your financial planning questions too.

Please tell me about the Financial Planning Process

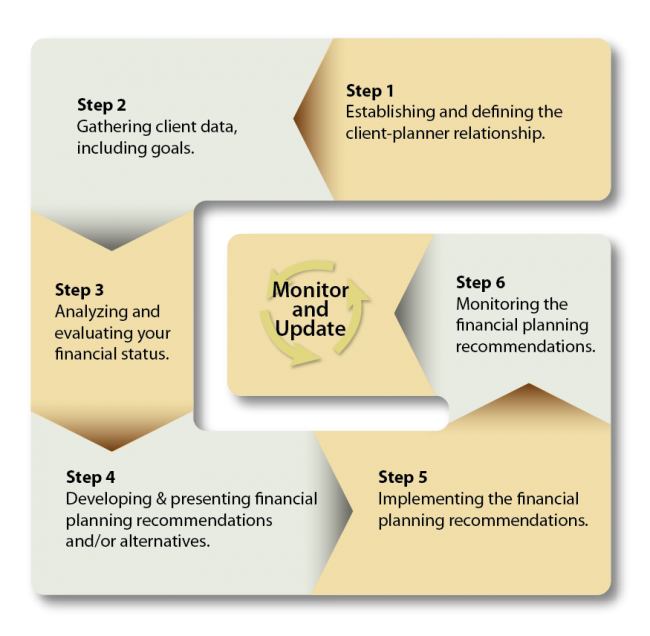

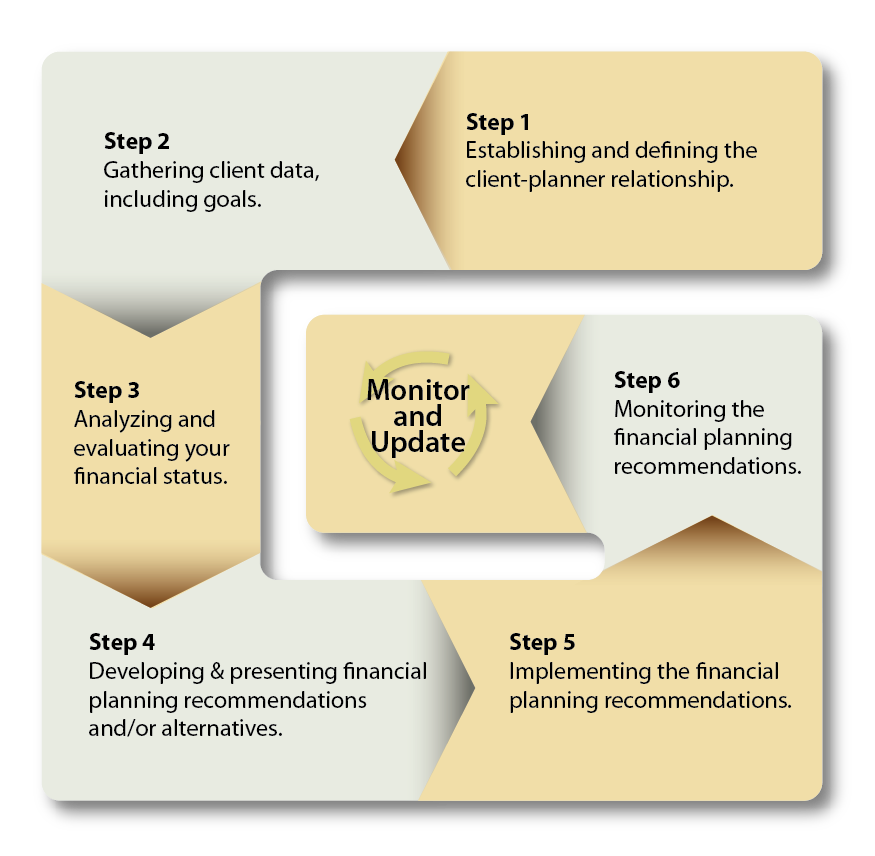

Financial Planning and analysis is a multi-step process that provides you with two important things: An in-depth review of your current financial situation and a blueprint that shows you how to achieve your goals and objectives for the future. Financial planning is a process, not a single event. Please click here to see the Guidepost Financial Planning process.

How do you create this blueprint?

First we focus on your goals, objectives, priorities and values. For instance, the reduction of current and future income taxes may be an immediate goal, funding a quality education for your children and/or grandchildren may be an intermediate goal and enjoying a secure financial future in your retirement years is likely to be one of your most important long-term goals. Another great goal in life for some people is creating wealth and/or leaving a legacy for your chosen beneficiaries or charities. You may already be on the road to meeting these objectives and simply need a new strategy, professional insight, or a fine-tuning of your plan. Are you just starting out or somewhere in between? Whatever your unique situation may be, everyone needs a periodic assessment of where they are on the road to meeting their financial goals. That’s why we do an in-depth review of you current financial situation.Next, you will need to know how you can go about achieving (or continue working toward) your financial goals. By focusing on cash flow, investments, taxes, pensions and retirement plans, estate planning, insurance issues, savings opportunities and other general financial matters, we design a customized financial plan for you. Finally, to achieve the intended results, you must implement and monitor your plan.

Sounds like a lot of work

It may seem like that at first, but there is good news. If you follow your plan and maintain a disciplined approach, you can rest well, knowing you can reach your stated goals. At Guidepost Financial Planning we try to make the financial planning process as easy as possible for you. In addition to receiving professional advice on your most important financial concerns, we can also provide implementation and ongoing asset management services, if appropriate for your needs.

Who can benefit most from your financial planning services?

Any individual seeking financial peace of mind can benefit from our financial planning services. We serve people at all income levels, from all walks of life. Clients have the flexibility to engage our financial planning services with a one-time, as-needed engagement or as an on-going relationship. We welcome clients who simply need a one-time financial consultation or a second opinion, as well as those who need comprehensive financial planning and ongoing asset management services.Each individual’s situation is unique. Some are just starting out and may need a detailed, long-term plan of action while others are already on the road to achieving their goals and may only need a new strategy, professional insight, fine-tuning or a second opinion of an existing plan. That’s why Guidepost Financial Planning works to customize our services to meet each individual’s needs.Goals can be short-, intermediate-, or long-term. Reducing current income tax liabilities for example, is a short-term goal, while funding a child’s education is an intermediate one and enjoying a secure financial retirement is more of a long-term goal.By focusing on cash flow, investments, taxes, pensions, retirement plans, estate planning, insurance issues, savings opportunities and other general financial matters, we can design a customized financial plan for you.

What is a fee-only financial planner and why should that be important to me?

Fee-Only financial planners, like Guidepost Financial Planning, are compensated for their knowledge and services, much like an attorney or a physician. We do not accept sales commissions; we work solely for our clients. We believe that when fee-only financial planners, such as our firm, do not receive third-party compensation, this is the surest way to obtain objective, impartial financial planning and advice. Because we do not sell financial products such as investments and insurance, there are no third-party relationships or outside influences to color our thinking or financial recommendations. For more information on fee-only financial planners, including our Code of Ethics, Fiduciary Code and member requirements, please visit The National Association of Personal Financial Advisors (NAPFA) website.In addition, our firm is a Registered Investment Advisor (RIA). As such, we must comply with a host of regulations designed to protect the consumer. One important question you should always ask when considering a financial planner’s services is “May I please have a copy of your ADV Part II?” This document contains important information about the planner’s qualifications, fiduciary duties, history of any past violations, etc. We would be happy to send you a copy of our ADV Part II. Please contact us to request your copy.

I understand the benefits of working with a fee-only financial planner, but I might need to obtain financial products. How will I be able to do that?

While we do not sell financial products, we will offer specific recommendations and opinions regarding the purchase of the various financial products that may be appropriate for you. So, if you need to obtain an insurance policy or a new mortgage, or find an estate planning attorney or tax professional, we can direct you to the resources you need and help you obtain these products and services. If appropriate, we can also help you implement your investment plan and set up your accounts for a fee.

Does Guidepost Financial Planning provide only comprehensive financial planning?

No. Although comprehensive financial planning can provide the greatest benefits, we can limit our advisory services to your specific needs, such as cash management and budgeting, investment analysis or college education funding.

My spouse and I are just beginning to build for our financial future. There is so much to learn! We need help and guidance to get started. Will you accept us as clients?

Yes. Some firms have income levels and/or net worth minimums but at Guidepost Financial Planning, we realize that everyone has financial planning needs. We are proud to work with people from all income levels, and all walks of life. Remember, you don’t have to have a fortune to start building one. Contact us today and let’s get started.

I have already accumulated substantial assets and think I am doing quite well. But as I progress and build for the future, things seem to be getting more complicated. I want to be sure I am on track, but I don't always have the time or inclination to manage the myriad details by myself. Can you help me?

Yes. People who need more sophisticated financial planning or advice will find our financial planning services appealing and beneficial. If you have a desire to simplify your financial affairs, our asset management services may be right for you. If you are looking for a professional review or a second opinion to ensure you are on track, we can provide that too.

What types of securities do you provide advice for?

We provide advice for all types of securities, including mutual funds, stocks, bonds, bank deposits, variable and fixed annuities. We also provide advice on mortgages, budgeting and cash flow issues, 401(k), 403(b) and other retirement programs, stock options, life and disability insurance, etc.If it has to do with money and finances, we can provide counseling, guidance and/or resources for you. Clients are encouraged to contact us when they have a major life event, such as a new job, a baby, a marriage or divorce, or if they are planning to buy a new home or start their own business.We also encourage our clients to contact us with more common everyday questions, such as:

- How should I invest within my 401(k) or 403(b) plan?

- How can I reduce my taxes?

- What advice can you offer on refinancing my home?

- How can I maximize my Flex Spending Account, Cafeteria Plan or Section 125 Plan at work?

If I use Guidepost Financial Planning to develop a financial plan, am I obligated to purchase the recommended products??

Absolutely not! We will offer recommendations which in our professional opinion will meet your needs and objectives, but you are under no obligation to purchase them. In today’s competitive market, it makes sense to shop around for the best available product or service. For instance, if you need to obtain a life insurance or disability policy, we will suggest the kind of policy, which riders and what amounts may be best for you. We will then direct you to a choice of companies that can provide a quality product at competitive prices for you. If you wish, we can help you purchase investments and/or set up your accounts with a third-party custodian such as a discount broker.

Tell me about your investment philosophy.

As financial planners and investment consultants, we believe in the following fundamental principles with regard to designing an investment portfolio and making specific recommendations:

- The purpose of a client’s investment portfolio is to fund current and/or future financial objectives.

- The design of the portfolio must take into account the client’s financial objectives, tolerance for risk, needs for current income or liquidity and special considerations such as income and estate taxes.

- The important thing to remember is that no one can predict the future. It is the difference of opinion that makes a market. Investment and economic “experts,” provided with the same information, often come to different conclusions. We do not suggest that we, or that any of the money or mutual fund managers that we recommend, will make the correct decision every time. We do believe, however, that studying the historic trends and relationships of investment classes and the philosophies and approaches of successful investment managers can provide valuable insight.

- The appropriate allocation of investment assets for your goals and risk tolerance is the most important component in developing and investment portfolio.

- We believe that by having a diversified, well-balanced portfolio and that by patiently following long-term, buy-and-hold strategies, you will increase the likelihood of achieving your long-term financial objectives.

How do you select investments for a client?

Before we recommend any investment, we consider the current economic conditions, the outlook for that asset class or type of security and how this investment fits within your portfolio given your objectives and tolerance for risk. For equity investments, we focus primarily on the philosophies, experience and track record of the management team. With fixed income investments, we look for the best yield available for a given quality of security. As fiduciaries for our clients, we strive to obtain the most appropriate investment vehicles to meet your objectives, while being very conscious of total expenses and risk exposure.

How do you price your financial planning services?

Hourly fees are based on the time involved in meeting with you in person or over the phone, researching and analyzing your current situation and providing specific recommendations and implementation assistance (if appropriate).Retainer or asset management fees are based on a percentage of the assets under management.

How much will my financial plan cost?

Financial planning fees are determined on a project basis. The total fee for a financial plan will vary from client to client based on the specific needs and complexity of your situation. An estimate is provided at the end of the no-charge, no-obligation initial meeting when your personal needs are fully identified. Once your financial plan is complete, you can do the implementation yourself (with as-needed guidance from us) or you can utilize our investment management services for the investment portion of your plan.

Are your fees tax deductible?

Yes, with certain limitations. Section 212 of the Internal Revenue Code permits an itemized deduction for tax and/or investment advice in the miscellaneous section of Schedule A. It is subject to a 2% floor of the adjusted gross income on a personal tax return.

Once my financial plan is completed, will our relationship end?

Depending on your client track, the actual engagement of services may end (please refer to our 6-step Financial Planning Process), but the majority of our clients choose to continue.

Because financial planning is a process, not an event, we offer ongoing services, periodic reviews and day-to-day consultation as requested and/or needed.

How can I get started?

The first step is an initial inquiry from you. Call us at 970.419.8212, email us or write us. We offer a no-charge, no-obligation initial meeting, either on the phone or at our office. Appointments are scheduled based on availability during regular business hours, Monday through Friday. Expanded office hours are available to accommodate special needs or emergency situations. Should you decide to engage our financial planning services, we can discuss which of our services and client tracks are appropriate for you. Most clients find the financial planning process to be stimulating and enlightening. The end result, of course, is greater peace of mind. We look forward to helping you build a brighter financial future as a partner on your path!