Whether you decide to help a family member (or a friend) with a loan or a gift, it can be tricky. This month we’ll provide some information to help you decide whether to make a family loan, gift or to do nothing at all.

Sometimes, it’s just best to do nothing at all. For example, you shouldn’t try to help if the money puts your finances in jeopardy. One example is borrowing from your retirement fund. If you decide not to help, you can soften the bad news by offering to help in some other way. Maybe you can help them research loans from other sources. Maybe you have the skills to help them with a remodel. Maybe you can provide some childcare to decrease their expenses. Maybe the family member can eat at your place for a while to decrease grocery expenses. You get the idea.

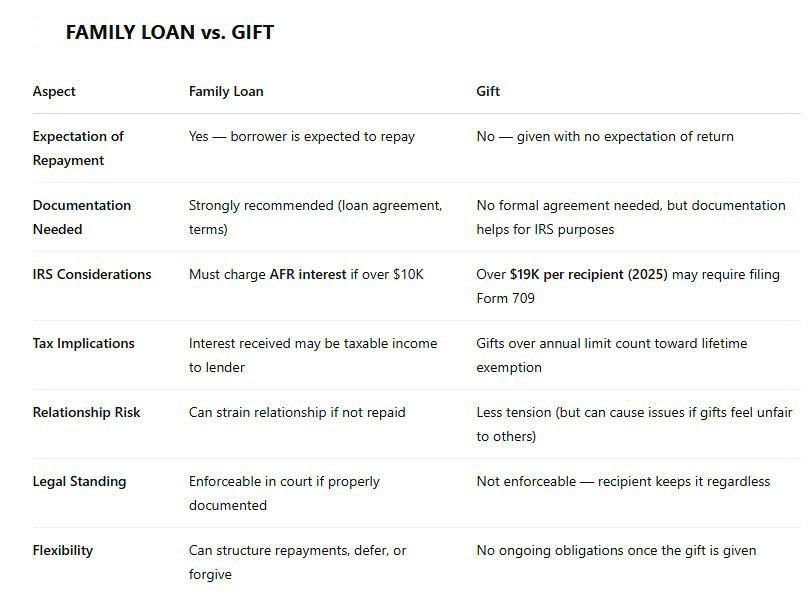

Now, if you think a loan or a gift is appropriate, here’s a handy chart to help you compare these options.

Once you decide which way to go, there are IRS considerations to keep in mind. Let’s start with the rules associated with a loan and then take a look at the rules for gifts.

IRS Rules for Family Loans

- Charge the Minimum IRS Interest Rate (AFR)

- The IRS requires you to charge at least the Applicable Federal Rate (AFR) for loans above $10,000.

- These rates are published monthly and vary by loan term. Short-term loans are under 3 years. Mid-term rates are 3-9 years. Long-term rates are for periods beyond that. As an example, the annual short-term rate for May 2025 is 4.05%. (By the way, you don’t need to adjust the AFR during the life of the loan.)

- If you don’t charge interest, or charge too little, the IRS may treat part of it as a taxable gift.

- Watch Out for Gift Tax Rules

- You can give up to $19,000 (as of 2025) per person per year tax-free.

- Anything above that may count toward your lifetime gift tax exemption (currently over $13 million, but still needs to be reported).

- Document the Loan Properly

- To show it’s a real loan, not a gift:

- Write a formal promissory note.

- Include interest rate, payment schedule, due date.

- Keep a record of all payments made.

- If the IRS audits either party, you’ll have proof it’s legit.

- To show it’s a real loan, not a gift:

- If They Don’t Repay

- If the borrower defaults, and you want to claim a bad debt deduction, the loan must:

- Be a bona fide loan (properly documented).

- Be completely worthless (no chance of repayment).

- Be reported as a nonbusiness bad debt—which is deductible only as a short-term capital loss (up to $3,000 per year for individuals).

- If the borrower defaults, and you want to claim a bad debt deduction, the loan must:

- Keep Good Records

- Even with family, treat it like a business deal.

- Log all payments received.

- Keep copies of checks, bank transfers, emails, or text confirmations.

IRS Rules for Family Gifts

- Annual Gift Tax Exclusion

- In 2025, you can give up to $19,000 per recipient per year tax-free, with no filing required. Married couples can combine exclusions and give $38,000 per person per year.

- Example:

- You give your niece $10,000 in 2025 → No problem.

- You give her $25,000 → $19,000 is excluded; the extra $6,000 must be reported on a gift tax return (IRS Form 709), but no tax is due unless you exceed your lifetime limit.

- Lifetime Gift Tax Exemption

- As of 2025, the lifetime exemption is $13.99 million per person. (Note that it will drop to $7 million per person in 2026 unless new legislation is approved.)

- If you gift more than the annual limit in a year, the excess counts against this lifetime exemption.

- You don’t owe taxes until you’ve gifted more than $13.99 million total.

- Example:

- Over time, you gift $1 million over the annual limits → You’re fine, it just chips away at your $13.99 million exemption.

- What Counts as a “Gift”

- Cash, property or forgiveness of debt (like forgiving a family loan).

- Selling something for less than fair market value.

- Paying someone else’s bills (tuition, rent, etc.) without getting something in return.

- Exceptions — What You Can Gift Unlimited Without Taxes

- Tuition (paid directly to an educational institution).

- Medical expenses (paid directly to the provider).

- Gifts to a spouse (if U.S. citizen).

- Gifts to political organizations.

- Reporting Gifts — IRS Form 709

- You must file Form 709 if:

- You give more than $19,000 to any one person in a year.

- You gift hard-to-value items (like art, real estate, etc.).

- You split a gift with your spouse.

- Note: Just filing doesn’t mean you owe tax; it just keeps track of your lifetime exemption usage.

- You must file Form 709 if:

You can see that it’s important to think through a potential family loan or gift. There are important IRS considerations as well. If you’d like some help analyzing this for your family situation, we’re available to talk things over in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.