Unfortunately, most people’s general education didn’t include some important life skills such as how to manage your finances. Of course, we develop many skills as life goes on just because we need them. Still, there are a handful of proven financial basics that aren’t common knowledge. It’s our hope that these best practices will help you on your financial journey.

- Educate yourself. The world is filled with honest people handing out bad advice. The world is also filled with biased advice. There are many crooks and con artists as well, who intentionally promote dishonest ventures. Each of us needs to be responsible for our own financial education so we can tell the difference between good advice, biased advice, and crooked advice. If you can educate yourself to know the differences between those three types of advice, reaching your financial goals is easy.

- Set measurable goals. If you are young, you may want to live a full life in a hurry. You might want all the trappings of the good life before you have really established yourself. However, set short-term (1-3 years) mid-term (3-7 years) and long-term (7+ years) goals. These will help you identify what you really want, and you can then plan to achieve the goals. Have a plan and stick to it!

- Spend less than you make.Spending less than you make opens the door to saving for the future. If you can’t afford the house, sell it. Can’t afford those car payments? Trade it in for a clunker you can afford. Get over your notion that money and material things are as important as you believe them to be. At a minimum you should save and invest 10-20% of each paycheck.

“Thousands upon thousands are yearly brought into a state of real poverty by their great anxiety not to be thought poor.”

-William Cobbett

- Pay yourself first. Put aside a set percentage from each paycheck or each payment you receive from other sources. Deposit that money into an investment savings account. Once your money goes into the account, NEVER take it out, until you are ready to invest it.

- Save on a regular basis. An easy way to accumulate wealth is to save and invest on a regular basis. The more frequently you save, the faster your balance will grow. Not only that, but investing on a regular basis also helps smooth out the highs and lows associated with a fluctuating market.

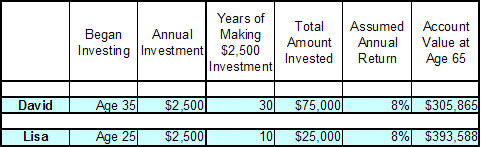

Start investing as early as possible. The earlier you begin investing, the greater the likelihood of you accumulating wealth. Why? It takes significantly less money to accomplish what you want when you have more time working for you. Check out the example of David and Lisa below to see what this really means. Lisa started saving ten years earlier than David, invested only one-third as much money and ended up with more at the end!

Start investing as early as possible. The earlier you begin investing, the greater the likelihood of you accumulating wealth. Why? It takes significantly less money to accomplish what you want when you have more time working for you. Check out the example of David and Lisa below to see what this really means. Lisa started saving ten years earlier than David, invested only one-third as much money and ended up with more at the end!

“The most powerful force in the universe is compound interest.”

-Albert Einstein

- Be an owner. The surest way to acquiring wealth is to be an owner. This means owning real estate, equity securities (stocks) or other appreciating investments. While being an owner means taking on risk, it also increases return (reward). Long-term averages show that equity ownership far outpaces fixed income (bonds) investments.

- Have a sensible investment strategy. Start with an asset allocation goal that divides your investments into equity, fixed income and cash investment categories. Your initial asset allocation should be based on your time horizon (age) and how you feel about taking on risk. If you are younger and more comfortable taking on more risk, allocating a larger portion of your funds to equities may help you earn the higher returns of stocks that have historically been available. However, remember that all investments involve risk and that past performance is no guarantee of future results.

- Know the Rule of 72. To be able to do compound interest problems in your head, the Rule of 72 gives you a lightning-fast benchmark to determine how good (or not so good) a potential investment is likely to be. The Rule of 72 says that in order to find the number of years required to double your money at a given interest rate, you can just divide the interest rate into 72. For example, if you want to know how long it will take to double your money at eight percent interest, divide 8 into 72 and get 9 years. The Rule of 72 is remarkably accurate, as long as the interest rate is less than twenty percent. You can also run it backwards. If you want to double your money in six years, just divide 6 into 72 to find that it will require an interest rate of about 12 percent.

- TAKE ACTION! Put a little money down. Start small. It’s amazing how quickly you learn when you have real money in the deal. Make mistakes, learn from them, and then take action again!

“Even if you’re on the right track, you’ll get run over if you just sit there.”

-Will Rogers

Want to learn more about these and other ways to realize your financial objectives? That’s exactly where Guidepost Financial Planning can help. Please visit our website or give us a call at 970.419.8212 so that we can discuss your financial goals in a no-charge, no-obligation initial meeting.

Comments are closed, but trackbacks and pingbacks are open.