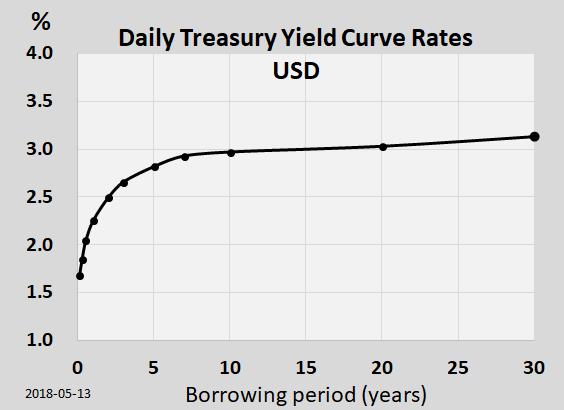

Yield curves are simply graphs of the interest rates of bonds with different maturities versus time. A commonly cited example is the yield curve for U.S. government securities. The rate for 3-month, 2-year, 5-year, 10-year and 30-year treasury securities are plotted on the vertical axis and the maturity period is graphed on the horizontal axis. Such a graph looks something like this:

This is what is called a normalized yield curve where longer borrowing periods receive higher interest rates. The reason for the higher future interest rate is the uncertainty of the future – particularly with regard to inflation. There are other forms of this curve such as a flat yield curve (short and long-term rates are similar) and an inverted yield curve (short-term rates are higher than long-term rates). The shape of this curve tells us something about how investors feel about the future. A positive outlook (economic expansion) leads to a normal curve. A negative outlook (recession) leads to an inverted curve. A belief that the economy is about to transition from a recession to an expansion (or vice versa) leads to a flat curve.

What’s particularly interesting about the yield curve is how accurately it forecasts a recession. The Federal Reserve Bank in San Francisco points out that an inverted yield curve has preceded all of the last nine recessions since 1955. (There was one false positive when the economy slowed down rather than going into an actual recession.)

Currently, government securities have a normal yield curve. (However, the difference between the 2-year and the 10-year government securities narrowed to 34 basis points (0.34%) in late July.) In addition, a JPMorgan global bond index recently inverted for the first time since 2007. So, while not foolproof, it is probably wise to be ready for a potential recession.

If you’d like to see if your portfolio is ready for a recession or discuss any other financial questions you might have, we’d be happy to talk with you in a no-charge, no-obligation initial meeting. Just visit our website or give us a call at 970.419.8212 to learn more.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.