You probably already know this, but as a reminder a 401(k) is a retirement savings plan offered by many employers that allows you to save and invest a portion of your paycheck before or after taxes, depending on the type of account you choose. (To avoid any confusion, there are also traditional and Roth IRAs that are available outside of 401(k) plans.) Currently, there are three types of 401(k) plans: Traditional, After-Tax and Roth. This month we will clarify the key differences between After-Tax 401(k) and Roth 401(k) contributions. They might sound similar, but they work quite differently, especially in terms of tax treatment, withdrawal rules and strategic uses.

Okay, let’s start with the basics. A Roth 401(k) is a type of employer-sponsored retirement plan that combines the features of a traditional 401(k) plan and a Roth IRA plan. It’s designed to give you tax-free income in retirement, as long as certain rules are met. Here’s how it works. You contribute after-tax dollars (unlike a traditional 401(k), which uses pre-tax funds). Your money grows tax-free. Qualified withdrawals in retirement are 100% tax-free — both contributions and earnings.

An After-Tax 401(k) is a type of contribution option within some employer-sponsored 401(k) plans that allows you to contribute beyond the regular 401(k) limits using after-tax dollars (but it’s not a Roth 401(k)). It’s primarily used by high-wage earners and super-savers to maximize retirement savings and potentially do a Mega Backdoor Roth conversion (don’t worry about this right now we’ll get to it in a bit).

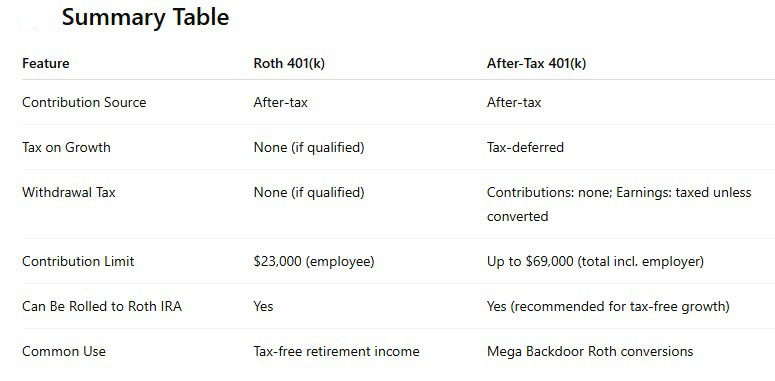

Let’s drill down just a bit on the key differences using this this chart.

You probably spotted that “Mega Backdoor Roth conversion” thing in the chart. Okay, here’s the deal. First of all, not all employers allow this in their 401(k) plan. If yours does, a Mega Backdoor Roth conversion works by converting your After-Tax 401(k) contributions to a Roth account, allowing you to stash away tens of thousands of extra dollars into tax-free Roth savings. Here are the steps you’ll need to take for this rollover: Max out your traditional/Roth 401(k) (that is, hit the regular contribution limit); add your After-Tax contributions (to go beyond the limit) and then convert to Roth (to ensure future growth is tax-free).

You probably spotted that “Mega Backdoor Roth conversion” thing in the chart. Okay, here’s the deal. First of all, not all employers allow this in their 401(k) plan. If yours does, a Mega Backdoor Roth conversion works by converting your After-Tax 401(k) contributions to a Roth account, allowing you to stash away tens of thousands of extra dollars into tax-free Roth savings. Here are the steps you’ll need to take for this rollover: Max out your traditional/Roth 401(k) (that is, hit the regular contribution limit); add your After-Tax contributions (to go beyond the limit) and then convert to Roth (to ensure future growth is tax-free).

Also, it’s worth emphasizing how the withdrawal taxes work. After-Tax 401(k) contributions do not receive the same treatment of growth in the account as a Roth 401(k) does. Only the contributions to the After-Tax 401(k) are tax-free. Unless your plan allows immediate conversion to a Roth 401(k), the After-Tax gains are taxable when withdrawn.

In summary, use a Roth 401(k) if:

- You expect higher taxes in retirement.

- You’re younger and want decades of tax-free growth.

- You want simplicity and qualified tax-free withdrawals.

And use an After-Tax 401(k) if:

- You want to contribute beyond the 2025 annual $23,500 limit (plus an additional $7,500 for those 50 and older).

- Your plan allows in-service withdrawals or conversions to Roth (enabling the Mega Backdoor Roth).

- You have maxed out other tax-advantaged options.

You can see that under the right circumstances, an After-Tax 401(k) contribution can really help you grow your retirement account. Some of the details can be a bit confusing, so If you’d like some help analyzing this for your situation, we’re available to talk things over in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.