Well, we’re just starting the third month of 2026, so it’s a good time to be sure that your retirement savings contributions are properly set up since it’s so much easier to fund these accounts over time instead of having to make larger contributions closer to retirement. This month we’ll cover the contribution and income limits for 2026 so you can contribute as much as you can afford within the IRS limits.

401(k) & 403(b) Contribution Limits

Employee Contribution Limit: $24,500.

Catch-up Contribution (ages 50 and above): $8,000 extra*.

“Super” Catch-up (ages 60-63): $11,250 (if your plan allows)*.

*Note: If your 2025 wages exceeded $150,000, catch-up contributions must be Roth (after-tax) rather than pre-tax—but your contribution limit ($24,500) stays the same.

Combined employee + employer contribution Limit: $72,000.

Individual Retirement Account Contribution Limits (Traditional & Roth IRA)

Annual contribution limit (combined Traditional + Roth): $7,500.

Catch-up contribution (age 50+): $1,100 additional.

Note: You must have earned income to contribute to an IRA. Spouses with no earned income may qualify under a spousal IRA rule.

Traditional IRA Deductibility Limits

Traditional IRA contributions are always allowed as long as you have earned income, but deductibility depends on your income. Your 2025 Modified Adjusted Gross Income (MAGI) determines whether your traditional IRA contribution is fully deductible. Here are a couple of examples for two types of filers.

Single Filers:

≤ $81,000: Full deduction.

$81,000 – $91,000: Partial deduction.

≥ $91,000: No deduction.

Married Filing Jointly:

≤ $129,000: Full deduction.

$129,000 – $149,000: Partial deduction.

≥ $149,000: No deduction.

Roth IRA Contribution Limits

Your 2025 Modified Adjusted Gross Income (MAGI) determines whether you can contribute to a Roth IRA. (Roth contributions are never tax deductible.)

Single Filers:

<$153,000: Full Roth contribution allowed.

$153,000–$168,000: Partial Roth contribution allowed.

≥$168,000: No direct Roth contribution allowed*.

Married Filing Jointly:

<$242,000: Full Roth contribution allowed.

$242,000–$252,000: Partial Roth contribution allowed.

≥$252,000: No direct Roth contribution allowed*.

*Note: While you can’t contribute directly to a Roth IRA above these limits, a backdoor Roth strategy may still be available.

The above summary doesn’t cover every possible situation. For example, there are rules for other types of filers such as those not covered by employer plan. Perhaps you have a different type of plan such as a 457(b) plan, Thrift Saving Plan, SIMPLE plan or a Simplified Employee Pension (SEP) plan. Or, maybe you’re wondering about how to use the backdoor Roth strategy. Whatever your questions on retirement contributions, or any other financial matters you’d like to discuss, we’d be pleased to meet with you in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.

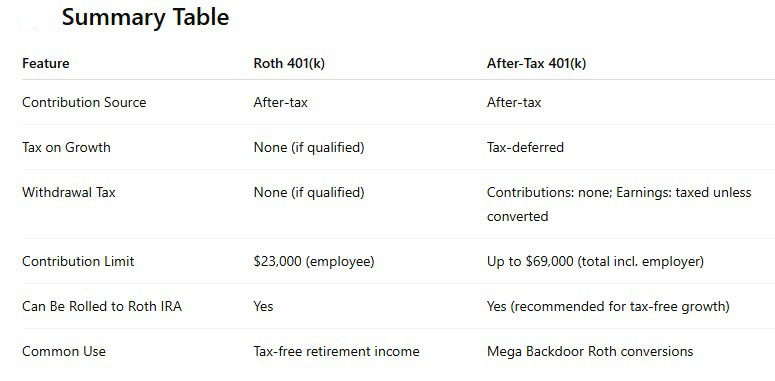

You probably spotted that “Mega Backdoor Roth conversion” thing in the chart. Okay, here’s the deal. First of all, not all employers allow this in their 401(k) plan. If yours does, a Mega Backdoor Roth conversion works by converting your After-Tax 401(k) contributions to a Roth account, allowing you to stash away tens of thousands of extra dollars into tax-free Roth savings. Here are the steps you’ll need to take for this rollover: Max out your traditional/Roth 401(k) (that is, hit the regular contribution limit); add your After-Tax contributions (to go beyond the limit) and then convert to Roth (to ensure future growth is tax-free).

You probably spotted that “Mega Backdoor Roth conversion” thing in the chart. Okay, here’s the deal. First of all, not all employers allow this in their 401(k) plan. If yours does, a Mega Backdoor Roth conversion works by converting your After-Tax 401(k) contributions to a Roth account, allowing you to stash away tens of thousands of extra dollars into tax-free Roth savings. Here are the steps you’ll need to take for this rollover: Max out your traditional/Roth 401(k) (that is, hit the regular contribution limit); add your After-Tax contributions (to go beyond the limit) and then convert to Roth (to ensure future growth is tax-free).