Yep, 2020 is almost over. (I know, many of us are saying thank goodness!) There’s so much going on in December that it’s difficult to find time for the important, but none urgent items. Here are a few important financial items that it would be good to take a look at.

Holiday Debt

It’s so easy this year to just click a mouse button and send a gift to someone. This is certainly the time for such things. The caution is that a little budgeting in December, can help you get off to a debt-free 2021. Even if you don’t have a formal budget, you can at least look at your cash flow and savings and think about how much debt you can pay off entirely when the bills roll in in January. You can get some additional ideas on this from my previous article Budgeting for the Holidays.

2021 Budget

Think how much easier it would be to budget for the holidays (and other expenses) if you had an actual budget to refer to. How detailed you want to be in your budgeting process is a personal decision. Some clients have spreadsheets that offer up-to-the-minute expense summaries. Some people still have envelopes filled with cash – one for groceries, one for rent and so forth. My article How to manage expenses in retirement has some good tips whether you’re already retired or not.

Reducing Interest

Why not go into 2021 with a plan to pay down your high-interest debt and minimize you mortgage costs? Credit cards are always worthy of debt retirement because their rates are so high. My article Using Credit Cards Wisely includes a discussion of the importance of paying off your debt monthly. A companion article talks about Another Reason to Eliminate Credit Card Debt. In terms of your mortgage, the interest is always a significant expense, so it’s well worth keeping an eye on rates which are still historically attractive. My articles Reducing Your Monthly Mortgage Payment and Should I Refinance My Home? Can help you evaluate this.

Finances and Your Spouse

Do you and your spouse regularly sit down and discuss finances? This can help align your goals, reduce financial tensions in your marriage and prepare each of you to take over if one of you is incapacitated or dies. I recommend scheduling a monthly meeting on this subject for next year (and beyond). How about just agreeing to go over things the first Sunday of every month over brunch or something enjoyable? Here are a few articles to get you thinking about these meetings: Talking Money with Your Partner, Financial Preparation for the Loss of a Spouse and The Role of a Financial Advisor When a Spouse Dies.

Savings

Unless you’re struggling with a job loss, you may have been able to save a little more in 2020. Maybe you had a staycation. Maybe you didn’t go out to eat or catch a movie. Maybe you didn’t hit the stores so much (or at all). Whatever your situation, it makes sense to look at the dollars you didn’t spend and consciously target them toward specific goals. Maybe increased retirement savings if your employer reduced his contributions. Maybe replenish your rainy-day or emergency funds if you had to use them this year. Whatever your savings goals are, unspent 2020 money is an opportunity for you.

Financial Advisor

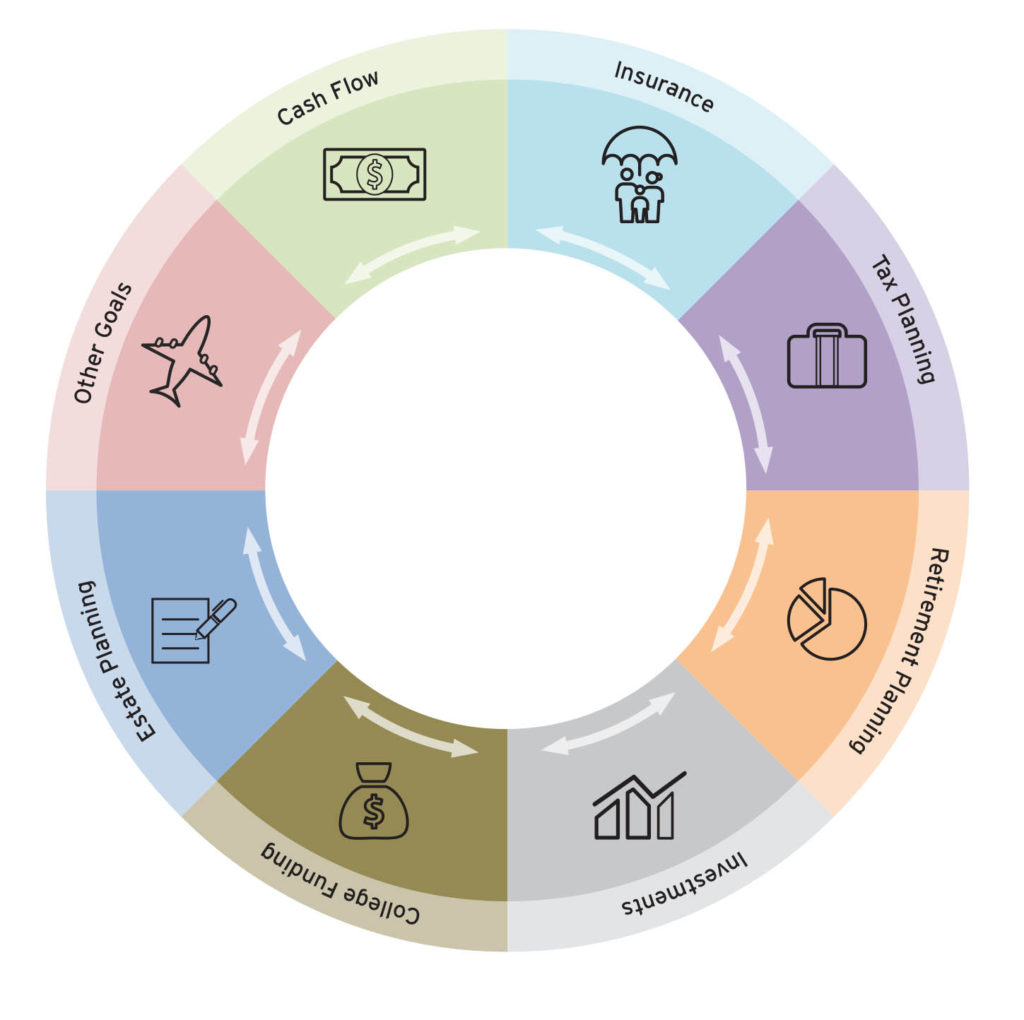

It’s always a good idea to have an expert go over your plans with you and discuss any potential revisions. (Or maybe even develop your first formal plan.) You might check out my article The Value of a Financial Advisor to get some ideas. The key thing is to make an appointment to do this now. Whether you actually get together before or after the holidays is not that important. The important thing is planning to do this.

I really encourage you to find some time to consider these suggestions. They’ll make your financial success in 2021 so much brighter. No matter which topic you want to drill down on, we can discuss this in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.