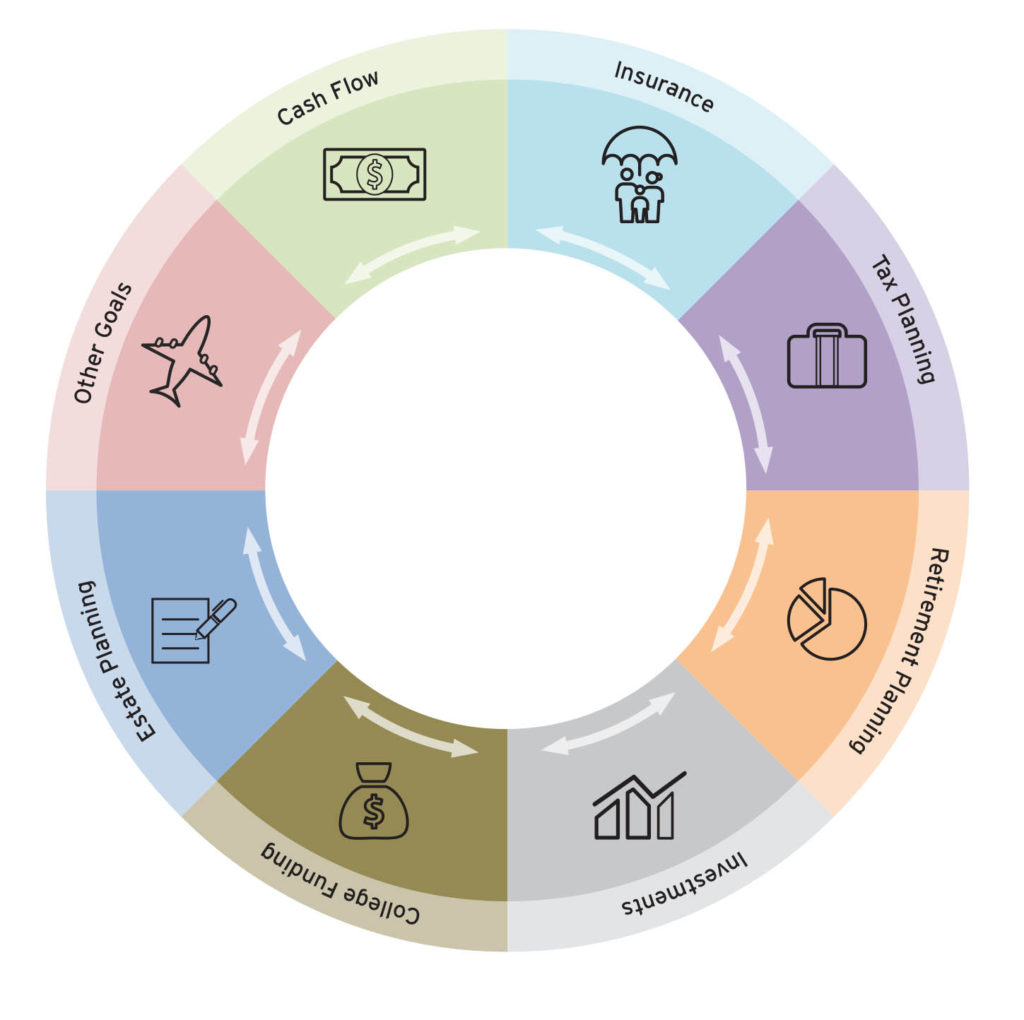

Your financial well-being depends on a number of factors and they’re all important. For example, suppose you don’t properly understand how much you need for retirement and you consequentially run out of funds near the end of your life. Or, suppose your savings are on track, but that a major medical event or a liability lawsuit depletes your savings. Or, maybe you haven’t reviewed your investments for a while and your asset allocation is now not what you planned for and a fall in the market leaves you overexposed. There are numerous examples of why it’s important to do comprehensive financial planning from time to time. The figure below identifies the areas that are typically covered in such a review. Let’s take a brief look at each area.

Cash Flow. Some people have substantial investments, but they’re not liquid enough to meet current expenses. When discussing cash flow, it’s common to go over emergency savings, reducing credit card and other high-rate debt, making sure that income can cover essential expenses and a developing a spending plan.

Insurance. Many of us think primarily of health insurance when insurance comes up. That is important – especially catastrophic health insurance. However, life insurance, disability insurance, liability insurance and long-term care insurance are vitally important too. Covering all of your insurance needs can give you peace of mind and protect your hard-earned investments.

Tax Planning. Naturally the goal of tax planning is to minimize your taxes so as to retain as much of your income as is possible. Last month I wrote an article on tax planning that you might like to review. During a tax-planning discussion, it’s typical to talk about your various sources of income and the tax-deferred investment options that might fit into your portfolio.

Retirement Planning. In retirement planning, you estimate your retirement expenses and plan out how to save enough to cover them. In addition to identifying savings targets, you’ll typically review IRAs, employer plans (401(k), 403(b), etc.) and deferred compensation. Finally, a review of Social Security, pensions and other income sources round things out.

Investments. Investments are, of course, at the heart of your financial plans. Reviews in this area typically include asset allocation, tax efficiency, diversification and the impact of the economy on financial markets.

College Funding. If you’ve got kids (or maybe grandkids), this can be a very important topic considering the cost of higher education. Discussions often include your current savings for college, ways to accumulate the desired funds (such as the use of 529 plans) and how to pay off any loans after graduation.

Estate Planning. This discussion includes much more than how much you want to leave to whom — which is typically covered in wills and trusts. It also covers healthcare directives, final arrangements, how best to title your assets and any legacy contributions you hope to make.

Other Goals/Planning. The previous categories cover most of the important topics, but there may well be some other areas that are specific to your situation. These might include purchasing a second/vacation home, travel plans, how to handle inheritance and other sudden-wealth situations and so on.

I hope you can see the importance of a comprehensive financial review. We can get you started on this or discuss other financial matters in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.