Who hasn’t wondered how long we should keep various documents? Keep them too long and it becomes unwieldy and makes it hard to find what you want. Don’t keep them long enough and you may not be able to respond to the tax man or some other authority. Is an electronic copy good enough or do we need hard copy? What’s the best way to get rid of documents we no longer need? There are many documents that you should keep for at least some time. We’ll take a look at some of the more common ones in this article.

Taxes

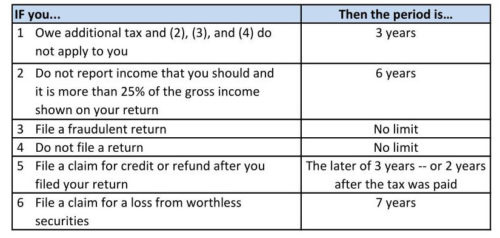

Retention Rules. The rules on this are reasonably straightforward. Here’s a chart from the IRS:

For most of us, 3 years is probably a pretty good retention period. On the other hand, who knows what the IRS may want to look at. So, unless item 6 applies to you, a 6-year retention period seems like a pretty safe bet.

That covers Federal tax returns, but how about your state returns? There is variation from state to state on this. Colorado, for example, is 4 years from the date you file your return or the date it is due — whichever is later.

Electronic or Hard Copy? Either.

What to Keep? You probably already have an idea which documents might be useful during an IRS audit since you needed those items to prepare your return. Naturally you’ll want to be able to verify your income (W-2, 1099, K-1, etc.) and expenses (invoices, receipts, cancelled checks, etc.). If you itemize you may have additional documents (charitable contributions, medical expenses, etc.).

Home Ownership

This is really an important special case of taxes. The price you paid for your home is its basis. The difference between that and the amount you receive when you sell it is the capital gain. It used to be that the entire gain was taxable, but you could reduce the gain by documenting all qualifying improvements that you made. This was pretty cumbersome, so the IRS now allows the first $250,000 of gain to be tax-free for individuals and the first $500,000 for joint filers. If your gain is higher than that, you may want to document at least major improvements (new addition, etc.) You should also keep the property’s abstract, title, appraisals, deed and all closing documents as well as receipts for major improvements. Mortgage documents, including the certificate you’ll receive once you pay off the mortgage, are also important.

Retention Rules. The same rules as for your taxes.

Electronic or Hard Copy? Either.

IRA

This is another important special case of taxes. Contributions to your IRA may include deductible or nondeductible funds. (This is typically based on your income in the year the contribution was made.) Naturally contributions of nondeductible funds become part of your IRA basis and are not taxed upon withdrawal. The best way to track your IRA basis/nondeductible contributions is to file Form 8606 each year that you make such a contribution.

Retention Rules. Until all of the funds have been distributed to you or your heirs.

Electronic or Hard Copy? Either.

Power of Attorney

Hopefully each of you has a medical and financial power of attorney document. This is used by your agent to take care of financial and healthcare decisions while you’re still alive, but unable to make such decisions yourself. Healthcare directives are useful in communicating the kinds of medical treatments you do or do not want to receive.

Retention Rules. As long as you are alive.

Electronic or Hard Copy? Original hard copies. Keep originals where your agent can access them. That means they should not be in a safe deposit box.

Estate Documents

As with Powers of Attorney, you should have your estate documents in order no matter what age you are and no matter how healthy you are. (The pandemic has certainly taught us that things can change very quickly.) Of course your key estate document is your Last Will & Testament. It tells your agent (executor) how to dispose of your assets. Trust documents are often part of your estate plan too.

Retention Rules. Until your estate is completely settled.

Electronic or Hard Copy? Original hard copies. Keep originals where your agent can access them. That means they should not be in a safe deposit box. (It’s interesting that your Will often grants access to your safe deposit box and if your Will is kept in the safe deposit box, it will be difficult to gain access!)

Protecting Documents

If your documents are kept as hard copies, the most important ones might be kept in a safe deposit box at your local bank. See Power of Attorney and Last Will & Testament exceptions to this. POAs and Wills might be kept in a safe at home (should be fire, water and theft resistant). Bulkier documents like 3-7 years of tax records and the supporting paperwork are often stored at home. This also makes the annual destruction of the oldest records and the addition of the newer records easier. People have different approaches to this. Many feel that the likelihood of record loss and an IRS audit are low and they just keep one copy at home. Others want more protection so they create an electronic copy of such documents to act as a backup. For electronic record keeping, it’s important to be sure the copy is legible. The other significant consideration is a good backup in the event that your primary copy is lost or damaged. Cloud services are one option for this if you’re comfortable with this important information being in the hands of others. You could also make a copy onto some storage device like a memory stick or DVD and place that in your safe deposit box. If you use this method, remember to update the offsite copy whenever important new documents occur.

Document Destruction

Hard copies can simply be run through an in-home shredder. Electronic copies can be deleted. However, you should know that even after deletion, the documents may still be present of the disk drive. So, it’s important to use some type of file wipe software to totally remove the files.

Of course document retention plans vary from person to person. If you’d like to discuss your situation, or any other financial matter, we can discuss this in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.