If you are already on Original Medicare or Medicare Advantage, you probably know that October 15 – December 7 is the Open Enrollment Period. That’s when you can make changes to your health insurance. Maybe you started out on Original Medicare and you’ve started to wonder if Medicare Advantage might be better for you. Or maybe you’ve been on Medicare Advantage and you want to go back to Original Medicare. Reevaluating your needs during Open Enrollment is certainly a good thing to do each year.

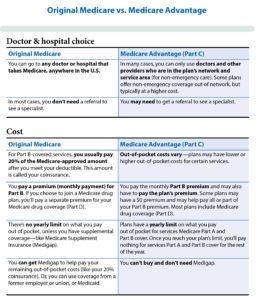

A good starting point is to clearly understand the difference between these two forms of health insurance. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount and you pay your share (coinsurance and deductibles). If you want Medicare drug coverage (Part D), you can join a separate Medicare drug plan. Medicare Advantage (also known as “Part C”) is a type of Medicare health plan offered by a private company that contracts with Medicare. These plans include Part A, Part B and usually Part D. Advantage plans may offer some extra benefits that Original Medicare doesn’t cover. The Medicare people prepared this graphic to help you easily understand the two Medicare offerings (Original & Advantage).

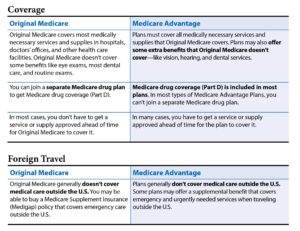

Now that you have a general understanding of the two types of Medicare, you’ll need to decide which one is best for you – and this varies from person to person. (Indeed, about half the participants use Original Medicare and the other half use Medicare Advantage.) Here’s a chart from Medicare that lays out the key differences.

Naturally you’ll have to look this chart over and watch for the things that matter to you. Considering the cost differences can be a somewhat complicated exercise. For example, will you add drug coverage to Original Medicare (most people should). Will you add supplemental (Medigap) insurance to Original Medicare (this varies depending on your situation)? Which company will you choose for Medicare Advantage (coverage and costs vary)? Do you want insurance to cover vision, hearing and/or dental services (use Medicare Advantage)? And after considering these various options, you should think about your total medical cost (insurance plus copays, etc.).

You can probably see that choosing the best medical insurance plan depends on the details of your situation. One approach is to look things over and then consult with an advisor. We’d be pleased to review medical insurance, or go over any other financial matter, in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.