No doubt you’ve heard of cryptocurrency. A common example of it is Bitcoin which we discussed in a previous article. You may be tempted to invest in this area due to some of the amazing gains reported. I want to provide a little background on this and then explain why I don’t recommend putting your money here.

Wikipedia has a pretty good overview of what cryptocurrency is:

Cryptocurrency is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities.

Individual coin ownership records are stored in a digital ledger, which is a computerized database using strong cryptography to secure transaction records, control the creation of additional coins, and verify the transfer of coin ownership. Despite their name, cryptocurrencies are not considered to be currencies in the traditional sense, and while varying treatments have been applied to them, including classification as commodities, securities, and currencies, cryptocurrencies are generally viewed as a distinct asset class in practice. (The IRS characterizes them as a capital asset.) When implemented with decentralized control, each cryptocurrency works through distributed ledger technology, typically a blockchain, which serves as a public financial transaction database.

The first cryptocurrency was Bitcoin, which was first released as open-source software in 2009. As of June 2023, there were more than 25,000 other cryptocurrencies in the marketplace, of which more than 40 had a market capitalization exceeding $1 billion.

Whew, that’s kind of a mouthful! Let me oversimplify this just a bit to try and clarify things. Okay, you go online and purchase a Bitcoin (or a similar product). You pay for it with money from your savings account (or other source of “real” currency). You receive a confirmation (called a token) that you own a Bitcoin. (Note that if you ever lose this token, you’ve lost your cryptocurrency too. Tokens cannot be reissued.) Later, you can convert the token back into real currency at a loss or at a gain. The fact that you purchased a Bitcoin is recorded in a rather complicated, encrypted computer process called a blockchain.

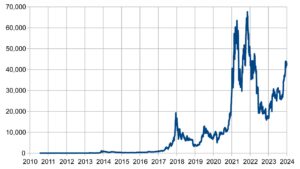

With that background, let’s talk about why I don’t like to have my clients put their money into it. Let’s start by taking a look at the Bitcoin’s price history.

You can see that if you’d purchased some prior to 2020, you’d have made a very nice profit (on paper). On the other hand, if you’d purchased some in 2020, today you’d be underwater to the tune of around $25,000. And if you’d needed to sell in 2021, you could have lost up to $50,000! This kind of volatility causes many financial professionals to liken cryptocurrency to speculation rather than investing.

I find Warren Buffet’s comments pretty much spot on. Here are a few that he made to CNBC:

- Cryptocurrencies basically have no value and they don’t produce anything. They don’t reproduce, they can’t mail you a check, they can’t do anything, and what you hope is that somebody else comes along and pays you more money for them later on, but then that person’s got the problem. In terms of value: zero.

- You’re going to be a lot better off owning productive assets over the next 50 years than you will be owning pieces of paper or bitcoin.

- In terms of cryptocurrencies generally, I can say almost with certainty that they will come to a bad ending.

- I don’t have any bitcoin. I don’t own any cryptocurrency, I never will.

So, putting money into cryptocurrency is akin to heading to Las Vegas. It might be fun, but you’d better be prepared to lose it all. Beyond that, it’s simply not an effective way to grow your personal wealth. If you’d like talk about cryptocurrency and better investment opportunities, or discuss any other financial matters, we can do this in a no-charge, no-obligation initial meeting. Please visit our website or give us a call at 970.419.8212 to set up an in-person or virtual meeting.

This article is for informational purposes only. This website does not provide tax or investment advice, nor is it an offer or solicitation of any kind to buy or sell any investment products. Please consult your tax or investment advisor for specific advice.